42 how to calculate a bond's coupon rate

Bond: Financial Meaning With Examples and How They Are Priced 1.7.2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate It is to be noted that the coupon rate is calculated based on the bond’s face value or par value, but not based on the issue price or market value. It is quintessential to grasp the concept of the rate because almost all types of bonds pay annual interest …

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · A bond's coupon rate is simply the rate of interest it pays each year, expressed as a percentage of the bond's par value. (It's called the coupon rate because, in days of yore, investors actually ...

How to calculate a bond's coupon rate

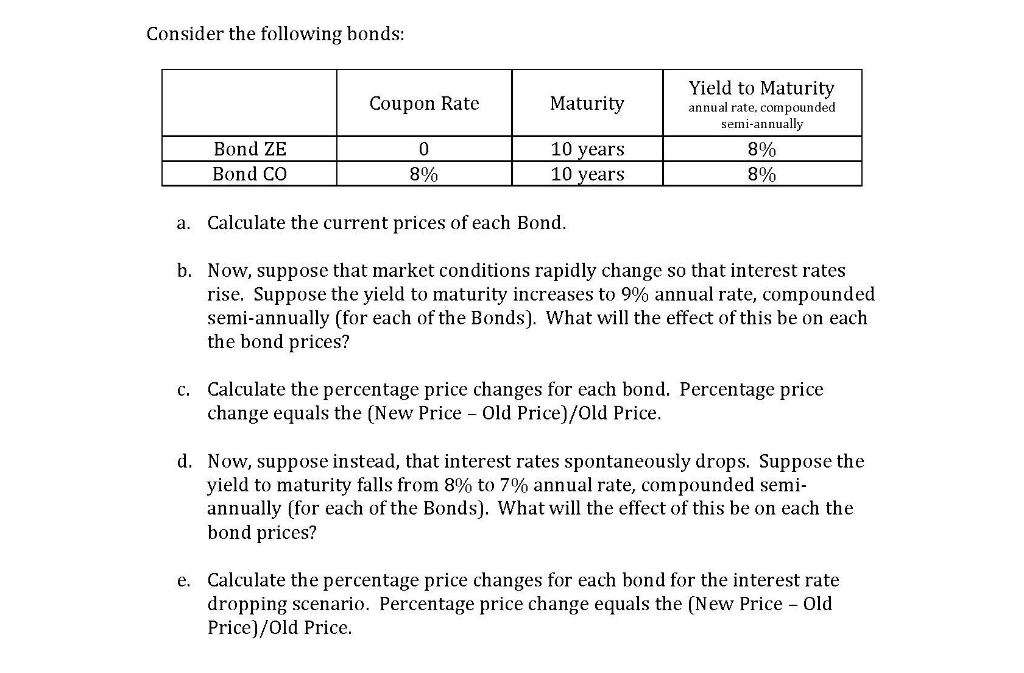

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a … How to Calculate Yield to Maturity of a Zero-Coupon Bond 10.10.2022 · This actually makes YTM easier to calculate for zero-coupon bonds. There are no coupon payments to reinvest, making it equivalent to the normal rate of return on the bond. YTM Over Time Learn to Calculate Yield to Maturity in MS Excel - Investopedia Mar 21, 2022 · Suppose the coupon rate on a $100 bond is 5%, meaning the bond pays $5 per year, and the required rate—given the risk of the bond—is 5%. Because these two figures are identical, the bond will ...

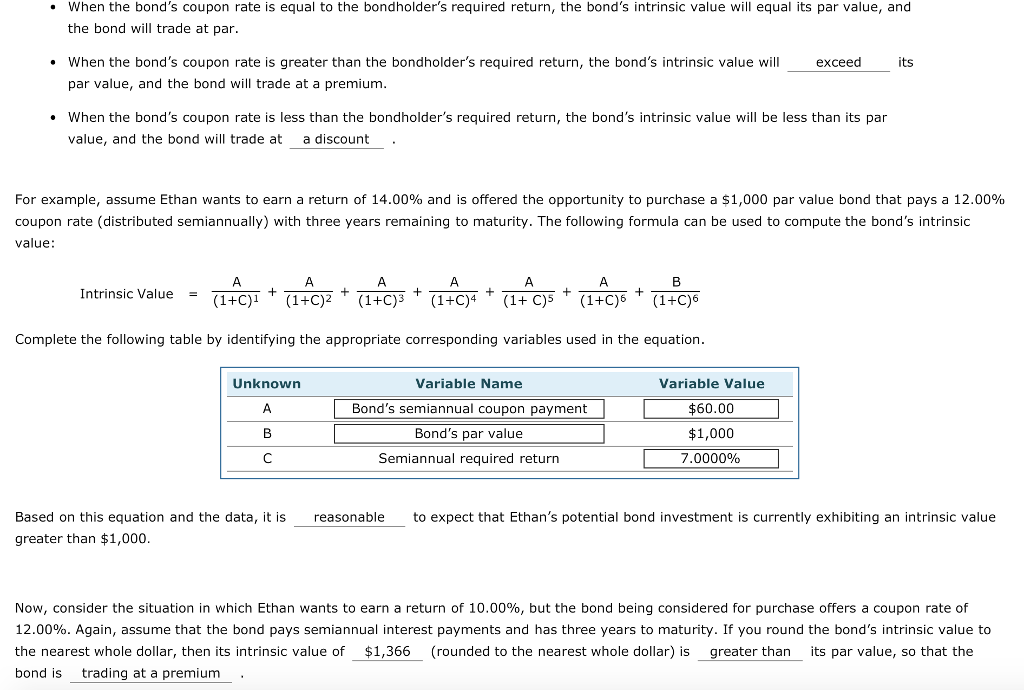

How to calculate a bond's coupon rate. When is a bond's coupon rate and yield to maturity the same? 13.1.2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. Coupon Rate Formula | Step by Step Calculation (with Examples) Here we learn how to calculate the Coupon Rate of the Bond using practical examples and downloadable excel template. Skip to primary ... The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond’s par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par ... How to Calculate Bond Discount Rate: 14 Steps (with Pictures) Jul 22, 2022 · For this calculation, you need to know the bond's annual coupon rate and the annual market interest rate. Also, find out the number of interest payments per year and the total number of coupon payments. Using the example above, the annual coupon rate is 10 percent and the annual current market interest rate is 12 percent. How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · The minimum expectation is based on the bond’s credit rating, and the interest rate paid by bonds of similar quality. Assume that you decide on a 4% discount rate for the $100 payment due in 5 years. The discount rate is used to discount (reduce) the value of your future payments into today’s dollars.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset 26.8.2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate. What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · The formula to calculate a bond’s coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Learn to Calculate Yield to Maturity in MS Excel - Investopedia Mar 21, 2022 · Suppose the coupon rate on a $100 bond is 5%, meaning the bond pays $5 per year, and the required rate—given the risk of the bond—is 5%. Because these two figures are identical, the bond will ... How to Calculate Yield to Maturity of a Zero-Coupon Bond 10.10.2022 · This actually makes YTM easier to calculate for zero-coupon bonds. There are no coupon payments to reinvest, making it equivalent to the normal rate of return on the bond. YTM Over Time

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a …

Post a Comment for "42 how to calculate a bond's coupon rate"