40 advantage of zero coupon bond

efinancemanagement.com › sources-of-finance › bondsAll the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. Basics Of Bonds - Maturity, Coupons And Yield To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101.

Tax Treatment of Bonds and How It Differs From Stocks First, as debt securities, they are often safer than stocks if you need to protect the principal in the event of a bankruptcy or default. 1 Second, they provide a consistent and predictable stream of interest income. As a result, bonds can provide some stability for your portfolio to counter the volatility of stocks, while still generating income.

Advantage of zero coupon bond

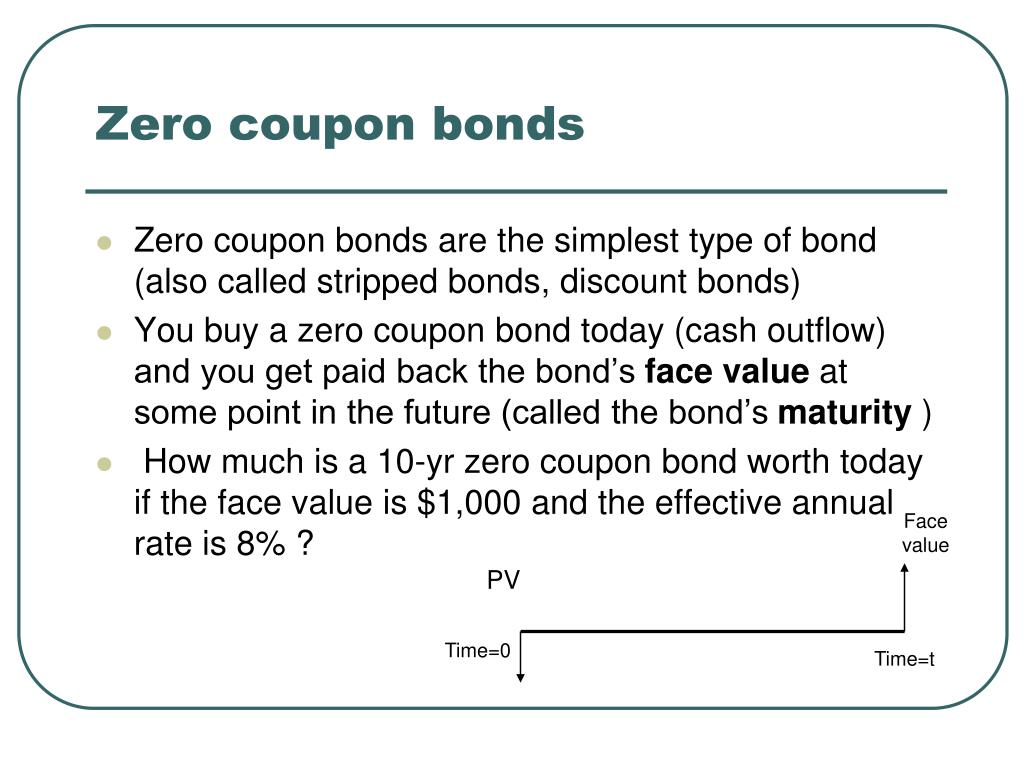

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. Zero-Coupon CDs: What They Are And How They Work | Bankrate One of the most significant advantages of a zero-coupon CD is that they are sold at a discounted price. You'll potentially earn a higher return than what traditional CDs offer since you didn't pay... Plain Vanilla Bonds - Meaning, Features, Example, & Advantages A 3-year bond that pays a 5% annual coupon rate (payment semi-annually) with the face value of USD 100.00 Therefore, in this plain vanilla bond - Coupon Rate = 5% of USD 100.00 = USD 5.00 per year Time of coupon payments = semi-annually = USD 2.50 every 6 months (USD 5.00/2) Date of Maturity = 3 years from the date of purchase

Advantage of zero coupon bond. Yield to Worst - Meaning, Importance, Calculation, and More Following are the advantages of calculating Yield To Worst: YTW give investors an idea of the minimum return they can expect in the future when the issuer may recall the bonds at the first available opportunity. Calculating YTW is crucial for markets with high yield or where bonds trade more than the face value i.e., at a premium. What Are High-Yield Bonds and How to Buy Them - NerdWallet Zero-coupon bonds do not make annual payments to the bondholder, but investors benefit when they receive the face value of the bond at maturity. ... The biggest advantage of investing in high ... RBI orders five banks to list zero coupon bonds at "fair value" A zero-coupon bond is not an interest bearing security. Unlike other bonds, it does not pay interest regularly. These are issued at deep discounts to their face value and are redeemed at face value on the maturity date. For example, a Rs 100 face value bond maturing in 10 years could be issued at Rs. 55. Types of Bonds - NerdWallet What are the advantages of a particular bond or bond exchange-traded fund? ... Treasury bills carry no interest, or "zero coupon," and a maturity ranging from several days to 52 weeks. Treasury ...

› article › understanding-bondsUnderstanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity. Reader Asks: Should I Put All My Bond Money Into TIPS? That is, when interest rates jump up and down these funds are about as volatile as the price of a zero-coupon bond due in 2029. Both funds have low fees. Both are good choices for the fixed-income ... Calculating the cost basis on a tax free Zero Coupon Bond Calculating the cost basis on a tax free Zero Coupon Bond A tax free zero coupon bond is issued with a yield to maturity of 3.5%. After some time, an investor buys the bond at 50. ( 50 cents on the dollar ). When he buys the bond, the bond has a yield to maturity of 3.4%. After some time, he sells the bond for 80 cents on the dollar. Buying Bonds: A Step-by-Step Guide | Learn More | Investment U Zero-coupon bonds: These bonds do not pay interest during their lifetime. Such bonds have long maturities, usually up to 10 or 15 years or more. ... Reinvest coupons: when buying individual bonds, reinvest your coupons to take advantage of compounding. This does not apply to bond funds, as the fund does so automatically. Bond Ratings.

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. Zero Coupon 2025 Fund | American Century Investments Zero Coupon 2025 Fund - BTTRX. Zero Coupon 2025 Fund. SUMMARY PERFORMANCE COMPOSITION MANAGEMENT. $106.43 | 0.13% ($0.14) NAV as of 06/08/2022. Historical NAV. Advantages and Risks of Zero Coupon Treasury Bonds Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. The... Investing in Zero Coupon in India Long-term zero coupon bonds are generally issued with maturities of 10 to 15 years. There is an inverse relationship between the time and the maturity value of a zero coupon bond. The longer the length until a zero-coupon bonds maturity date the less the investor generally has to pay for it. Zero coupon bonds with a maturity of less than a year ...

Why Are Bonds Down? - forbes.com The table shows the initial price of a ten-year $1,000 zero coupon bond for several different interest rates. For example, lending $905 to receive $1,000 in 10 years yields 1%.

Discount Bond - Bonds Issued at Lower Than Their Par Value When a new bond is issued, it comes with a stated coupon that shows the amount of interest bondholders will earn. For example, a bond with a par value of $1,000 and a coupon rate of 3% will pay annual interest of $30. If the prevailing interest rates drop to 2%, the bond value will rise, and the bond will trade at a premium.

Advantages of Options Over Futures - ICICIdirect Here are the benefits of options trading: Flexibility As an investor in Options, you have the alternative to walk away from your contract at any point in time. In Options, buyers are not under any obligation to execute the contract. However, in Futures, both buyers and sellers are obliged to do so. Cost-efficiency

zero coupon bond - Definition, Understanding, and ... - ClearTax

What are the advantages and disadvantages of zero-coupon ... Feb 4, 2017 — A zero coupon bond is a bond that pays off at maturity, but makes no payments until maturity. It is sold at a discount. They are much more sensitive to yield ...8 answers · 0 votes: Advantages: • You can predict return • Low minimum investment • Minimal Risk • Attainment ...What is the disadvantage of issue zero coupon bond ...2 answersMar 23, 2018What are the benefits to the issuers of zero-coupon ...1 answerApr 18, 2021What is a zero-coupon bond? What are the advantages ...2 answersMay 3, 2021Why do companies issue zero coupon bonds? - Quora3 answersOct 24, 2017More results from

Bonds: What They Are & How They Work | Seeking Alpha Zero-coupon bonds: do not pay interest but trade at a deep discount instead, ... As with all investment types, there are advantages and disadvantages to investing in bonds.

Zero Coupon Bonds - Taxation, Advantages & Disadvantages This is because zero coupon bonds can help in securing a guaranteed return at the end of a fixed time period. Since these bonds offer discounts for longer investment tenures, they are ideal for those who have long-term investment plans. What are the benefits of investing in Zero-Coupon Bond?

Zero-Coupon Bond Definition - Investopedia Because they offer the entire payment at maturity, zero-coupon bonds tend to fluctuate in price, much more so than coupon bonds. 1 A bond is a portal through which a corporate or governmental body...

What is a Zero Coupon Bond? - ICICIdirect The most significant advantage of a zero-coupon bond is that the returns that you receive on them are known in advance. You buy the bond at a discount on the face value, and you know the maturity amount you will get at redemption. However, yield could vary if you sold the bond in the open market before maturity. 2. There is no reinvestment risk

› terms › pPerpetual Bond Definition - Investopedia Mar 19, 2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ...

Types of bonds — AccountingTools Zero Coupon Convertible Bond A zero coupon convertible bond allows investors to convert their bond holdings into the common stock of the issuer. This allows investors to take advantage of a run-up in the price of a company's stock. The conversion option can increase the price that investors are willing to pay for this type of bond. Bond Features

corporate.americancentury.com › content › corporateGlossary | American Century Investments Zero-coupon securities Zero-coupon securities (aka zeros) are debt securities that, unlike most of their debt security counterparts, make no periodic interest payments to investors. Instead, they are sold at a deep discount (with an imputed interest rate priced into the discount), then redeemed for their full face value at maturity.

Types of Bonds with Durations and Risk Levels - The Balance If you want to take advantage of bonds, you can also buy securities that are based on bonds, such as bond mutual funds. These are collections of different types of bonds. One of the differences between bonds and bond funds is that individual bonds are less risky than bond mutual funds. U.S. Treasury Bonds

ZERO COUPON BONDS - The Economic Times The government had relied on zero coupon bonds for the first time last year when it used it to infuse Rs 5,500 crore in state-owned-Punjab and Sind Bank. The government had budgeted Rs 20,000 crore in FY21 towards bank recapitalisation and it is yet to decide on infusion of the balance Rs 14,500 crore.

Accounts That Earn Compounding Interest | The Motley Fool A zero coupon bond holder purchases a bond at a steep discount, receives no interest payments (coupons) in exchange for holding the bond, and is paid the bond's face value when the bond is due ...

Post a Comment for "40 advantage of zero coupon bond"